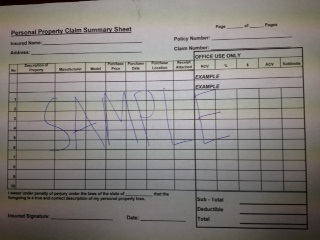

After a major event such as a fire or tornado the insurance adjuster will hand you what is called a personal property inventory form. These forms are nicely printed forms where you are to list everything you h...ave purchased over the last twenty or thirty years that has been lost.

This task comes at a time when you've already not in the best of moods. A good HOME INVENTORY can save you both time and money. With the age of digital photography it's easy to click pictures of closets, garages, attic, and all the various rooms of the home.

Most men are amazed on the value of personal property located in the kitchen draws and cabinets. Don't forget the food pantry and various freezers that may be on the property. Women are amazed at the value of tools and sporting equipment located in the garage, out building or attic.

Guns, jewelry, furs, collections all have special limits on most homeowners policies. This is also a good time to remind everyone that flood is a unique peril that requires a Federal flood policy that can be purchased through our office. We will discuss flood in depth in another letter.

If you have any motorized vehicles or watercraft on the property they almost always require a separate policy. Every deer season someone will lose a four-wheeler that they assumed was covered under a homeowner's policy.

Once you complete the inventory make sure it is stored in a safe place. After the recent Bastrop fires adjusters learned that people had inventories but stored them in the home that was a total loss.

The home inventory does not eliminate the need to complete the personal property inventory forms but it makes the task much easier. You don't want to realize next Christmas that you forgot to list thousands of dollars of decorations used once a year.